Why RHOA's Kandi's Conversation About Estate Planning is Important to Black Families

The most recent season of The Real Housewives of Atlanta discussed an important topic: estate planning and black families. RHOA cast member Kandi Burruss led the estate planning conversation, with her mother, Joyce expressing strong opinions about her wishes. Learn more about the Grammy-winning musician, songwriter, and actress's blunt conversations and why they are so important to the black community.

The Mama Joyce Factor

Kandi's mother, known on the show as Mama Joyce Jones, believes the songwriter and her husband, Todd, need to have serious estate planning and asset distribution discussions.

"When you are gone, why are you going to set somebody up with a lavish lifestyle?" said Joyce, arguing that if her daughter passed for any untimely reason, her husband should not inherit most of her assets. If that were to occur, Mama Joyce said the singer's eldest daughter might not get the money or other assets she deserves.

She argued that Todd might be inclined to give the singer's younger children more money. The eldest daughter is from a previous relationship, while the younger children are with her husband Todd, who also has a child from another relationship.

Kandi noted in a post-show interview that she and Todd "have a long way to go" regarding estate planning. She said that she and her husband would most likely have separate trusts and a joint trust. Of the joint trust, Kandi said, "The trust together, we're still going to have some of those things where we bump heads on."

Some show fans criticized Kandi for saying she would prefer Todd to remain "legally single" if she passed, with others praising her for taking care of her family.

"Interesting how so many people have responded without seeing what Kandi said," one fan wrote on Twitter. "This isn't about stopping him from being in love with someone else; it's about protecting what she has worked her entire life for and wants to pass down to her children. It's not selfish; it's smart."

Common Issues for Black Americans and Estate Planning

The fact that Kandi and her husband have disagreed about how to divide their assets is a common issue black families, and all families with assets and multiple children face. Such disagreements are compounded when the family is blended, like Kandi and Todd's. The frank conversation the couple had on national television sheds light on an issue that has affected the black community for years.

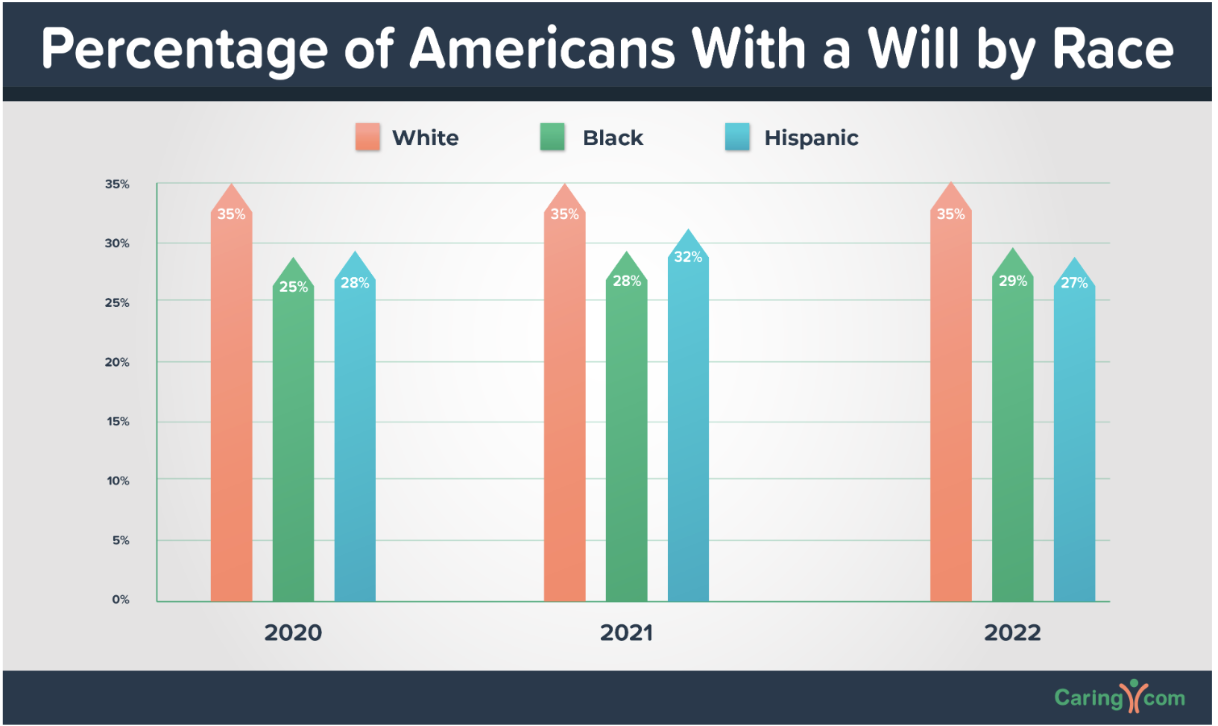

Wealthy black celebrities such as Aretha Franklin, Prince and Chadwick Boseman passed without a will because estate planning is not a common black community practice. According to Caring.com’s 2022 survey on estate planning, even though 27.5% of black individuals have wills as of 2021 compared to 25.9% in 2020, the percentage is still low.

According to Brickson Diamond, co-founder of the nonprofit Black House Foundation, which focuses on providing film industry opportunities for black individuals, the largest wealth transfer in history is currently taking place. Unfortunately, says Diamond, black Americans are currently missing out on this transfer and its benefits.

Why Having an Estate Plan Matters

Creating an estate plan that includes the last will and related documents, such as assorted trusts, avoids probate issues. If a wealthy individual passes without naming their beneficiaries in their will and trusts, their assets are divided by the state in probate court. This can result in months and months of court dates from family members arguing over what is rightly theirs.

Court fees accumulate, and the stress level of family members can increase significantly. Establishing an estate plan avoids all of these issues, allowing beneficiaries to receive their inheritance promptly and use the assets they see fit, such as paying off credit card debt and purchasing homes for the first time.

Estate plans also ensure specific wishes are carried out. The right people receive the assets, as do any charitable organizations. Creating an estate plan provides invaluable peace of mind because wishes are executed exactly as instructed.

Tips For Creating an Estate Plan

Devising an estate plan takes time, making it a good idea to do the right research and think critically about who the beneficiaries should be. Research can include learning more about trusts. Most trusts are money or assets set aside for a certain period before they are bequeathed to the designated beneficiaries.

They are usually available when the trust owner dies, or the beneficiary becomes a legal adult. Picking trustees typically involves thinking about who needs the money the most and is financially savvy enough to use the assets responsibly.

Estate plan creation also requires considering the taxes involved. Depending on the beneficiary's amount, they might have to pay taxes. For example, taxes are owed if an asset is bequeathed to a grandchild but said child is 29 years younger than the property owner. If the grandchild is at least 37.5 years younger than their grandparent, taxes do not apply.

There are also state and federal estate taxes to consider, with some states allowing beneficiaries to receive their assets without taxes. However, it is necessary to pay federal estate taxes regardless of the property owner's location.

Contact a Georgia Estate Planning Attorney Today

If you need assistance creating an estate plan, contact SmithTaire Legal today. Georgia Estate Planning Lawyer Jammie Taire has helped individuals and families create estate plans they have been happy with for years. Call our office at (678) 253-8133 today to get started or learn more about our estate planning services online.